Dr. Ahmet Temiroğu emphasizes the strategic importance of Türkiye’s garment and textile sector in terms of economic, social and exports. The sector contributes 7-8% to Türkiye’s GDP, directly employs 1 million people and has the highest female employment rate. In 2023, the sector realized exports of 24.123 billion dollars, with a 10.5-11% share in foreign trade. With its high domestic value added ratio, it plays an important role in closing Türkiye’s foreign trade deficit. However, it is experiencing difficulties due to the crises in 2024. Temiroğu states that the production of high value-added products will take time and that it is critical to support the textile sector in this process.

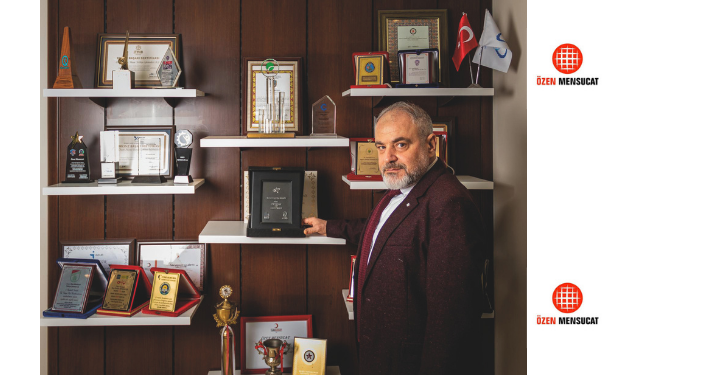

Dr. Ahmet Temiroğu, CEO of Özen Mensucat:

“The importance of the textile and ready-to-wear sector for Türkiye

In Türkiye, the garment and textile sector is one of the pillars of the national economy with its contribution to the economy, the employment it creates, its power in exports and its foreign trade surplus. In this article, we will discuss the sector in terms of its contribution to the economy, social life and employment, and the current account surplus and added value it generates in exports and exports, and try to express its importance for Türkiye in figures.

Contribution to the economy

The garment and textile sector plays an important role in Türkiye’s industrial production. The sector makes a direct contribution of approximately 7-8% to Türkiye’s GDP. As of 2023, the total size of the sector is around 40 billion dollars. In addition to the value created directly, the economic value created indirectly through sub-sectors and subsidiary sectors is much, much greater for the Turkish economy.

Contribution to social life and employment

The garment and textile sector is a sector that lightens Türkiye’s employment burden and provides job opportunities especially for disadvantaged groups. This sector directly employs 1 million people and indirectly 2 million people. It is the sector with the highest female employment rate in Türkiye, with approximately 50% of its employees being women.

On the other hand, this sector, which has the characteristics of chimneyless and clean production and is dominated by small and flexible enterprises, is also located in rural areas and small cities, reducing migration and supporting regional development.

In these respects, the garment and textile sector has an impact on improving social life.

Contribution to exports

Between January-October 2023, Türkiye exported a total of 24,123 billion dollars, 14,382 billion dollars in ready-to-wear and 9,741 billion dollars in textiles. In recent years, the textile and ready-to-wear sector has realized approximately 10.5%-11% of Türkiye’s total exports. Türkiye ranks in the top 10 in ready-to-wear exports and in the top 5 in textile exports in the world ranking. Especially in exports to European Union countries, the sector is one of Türkiye’s strongest trump cards. Approximately 40% of total exports from Türkiye to EU countries are made by this sector.

In 2024, the sector was severely affected by the crisis environment in the world and in Türkiye, and the majority of enterprises were unable to make a profit. In particular, due to the huge gap between inflation and the exchange rate, the sector had difficulty in keeping prices in exports and continued to produce and export even at a loss in order not to lose its customers.

In 2024, the sector exported a total of 22.765 billion dollars between January and October, including 13.248 billion dollars in ready-to-wear clothing and apparel and 9.517 billion dollars in textiles and raw materials.

Contribution to foreign trade deficit

The garment and textile sector has been the champion of Türkiye’s exports for many years. In recent years, it has ranked third after the automotive and chemical industries. However, the garment and textile sector has the highest domestic value added ratio in Türkiye. Approximately 60-70% of the inputs used in exports are provided by domestic resources.

Especially cotton production is an important factor that increases the domestic value added ratio in the sector. Türkiye is one of the major cotton producers in the world and this cotton is processed in the domestic market and exported. The high domestic cotton production capacity relatively increases the sector’s resilience to economic fluctuations.

Therefore, unlike many other sectors, the ready-to-wear and textile sector has a foreign trade surplus structure. In 2023, the sector generated a total foreign trade surplus of approximately 12 billion dollars. Imports of raw materials and intermediate goods used in apparel production are quite low compared to the sector’s exports.

However, while the automotive sector, which is the export champion in Türkiye in 2023, exported approximately 32 billion dollars, it imported approximately 26-28 billion dollars for parts, equipment and raw materials used in production in the same period. The automotive sector generates limited domestic value added due to its high import dependency. On average, 60-70% of a vehicle produced in Türkiye consists of imported inputs. The actual domestic value added ratio is around 30-35%.

The chemical sector, which ranks second after the automotive sector, is even worse in terms of domestic value added. Türkiye’s chemical sector exports amounted to around 33 billion dollars in 2023. On the other hand, the chemical sector spent around 45-50 billion dollars on imports of raw materials and intermediate goods. The chemical sector is highly dependent on imports. Most of the petroleum derivatives, plastics and chemical raw materials are imported. The domestic value added ratio is around 20-25%.

The sector’s import dependence leads to a negative net export contribution; the chemical sector imposes a burden of between -10 and -15 billion dollars on the foreign trade balance.

Conclusion

Türkiye’s garment and textile sector is of strategic importance not only for its economic size but also for the social and economic benefits it generates. With its high export performance, capacity to generate foreign trade surpluses and wide employment network, this sector is an indispensable part of the Turkish economy.

Türkiye must, of course, produce and export technological products with high added value. However, this is not a task that can be achieved today and tomorrow. Because in order to achieve this, our universities should have been conducting scientific research for many years, and our industrialists should have carried out very serious and time-consuming R&D studies in cooperation with universities. Unfortunately, both our universities and industry have not shown the required performance in this regard. Therefore, Türkiye’s goal of producing and exporting high value-added products is a goal that is difficult to realize in the short term. Türkiye will of course achieve this by giving much more importance to scientific studies and R&D activities. However, until this goal is achieved

Our country needs the textile and ready-to-wear sector.

Because this sector is of strategic importance for Türkiye. It employs one million people, half of whom are women. This employment figure is an important amount for the sociology of Türkiye and thus prevents the social balance from deteriorating due to unemployment.

On the other hand, the role of the Turkish Ready-to-Wear and Textile Sector in closing the foreign trade deficit cannot be neglected considering the current situation of our country’s economy.

When we close our export deficit by producing and exporting high value-added products and give foreign trade surplus, then maybe we can give up textiles and ready-to-wear clothing.

However, the textile and ready-to-wear sector will never stand still, will move towards sustainable production, strengthen its technological infrastructure, concentrate on branding, focus on high value-added products and continue to contribute to Türkiye’s global competitiveness.

Therefore, supporting the sector during this crisis period is of critical importance for economic development, social welfare and strategic importance.”